All Categories

Featured

Table of Contents

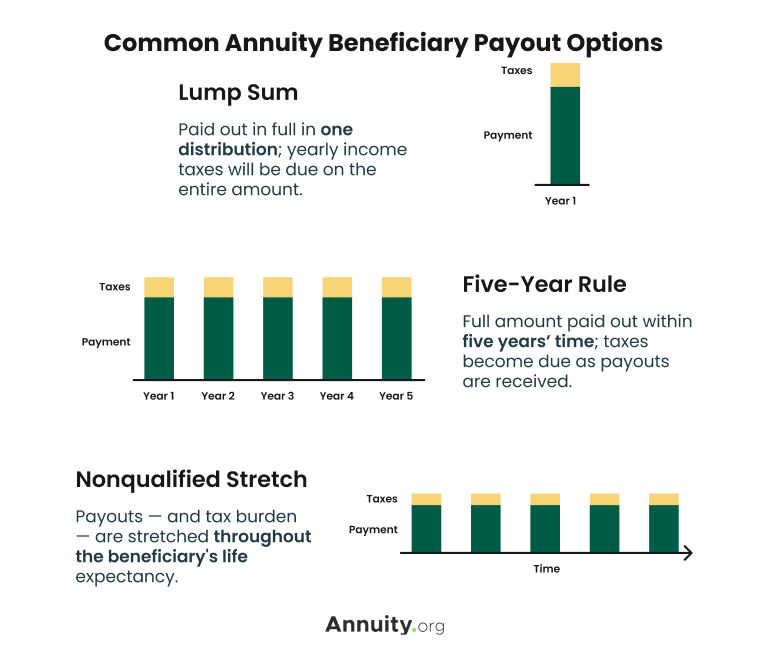

This five-year basic regulation and 2 following exceptions use only when the owner's death causes the payment. Annuitant-driven payments are discussed below. The first exemption to the general five-year guideline for private beneficiaries is to approve the fatality advantage over a longer duration, not to exceed the expected lifetime of the beneficiary.

If the recipient elects to take the survivor benefit in this approach, the benefits are exhausted like any various other annuity repayments: partially as tax-free return of principal and partly gross income. The exclusion proportion is found by using the departed contractholder's cost basis and the anticipated payments based on the recipient's life span (of much shorter duration, if that is what the beneficiary selects).

In this approach, occasionally called a "stretch annuity", the recipient takes a withdrawal yearly-- the required amount of yearly's withdrawal is based on the same tables made use of to calculate the needed circulations from an IRA. There are two benefits to this technique. One, the account is not annuitized so the recipient retains control over the cash money worth in the agreement.

The 2nd exemption to the five-year regulation is readily available just to an enduring spouse. If the marked recipient is the contractholder's partner, the spouse may choose to "step right into the shoes" of the decedent. Essentially, the spouse is treated as if he or she were the owner of the annuity from its creation.

How are beneficiaries taxed on Annuity Interest Rates

Please note this uses only if the spouse is named as a "designated recipient"; it is not offered, for circumstances, if a trust is the recipient and the spouse is the trustee. The basic five-year rule and both exceptions only use to owner-driven annuities, not annuitant-driven agreements. Annuitant-driven contracts will certainly pay survivor benefit when the annuitant dies.

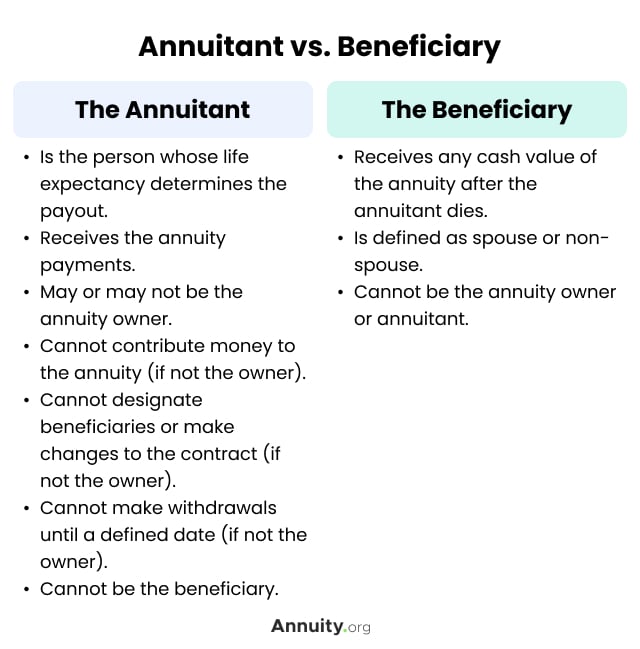

For purposes of this discussion, assume that the annuitant and the proprietor are different - Annuity beneficiary. If the agreement is annuitant-driven and the annuitant passes away, the fatality triggers the survivor benefit and the beneficiary has 60 days to determine exactly how to take the survivor benefit subject to the regards to the annuity agreement

Note that the option of a partner to "tip into the footwear" of the owner will certainly not be offered-- that exception applies only when the proprietor has died but the owner didn't pass away in the circumstances, the annuitant did. If the recipient is under age 59, the "fatality" exception to prevent the 10% fine will not apply to an early circulation once again, since that is available only on the death of the contractholder (not the death of the annuitant).

As a matter of fact, lots of annuity firms have inner underwriting policies that reject to issue agreements that call a various owner and annuitant. (There may be weird scenarios in which an annuitant-driven agreement fulfills a customers unique requirements, however generally the tax negative aspects will surpass the advantages - Annuity death benefits.) Jointly-owned annuities may posture comparable troubles-- or a minimum of they might not offer the estate preparation feature that jointly-held assets do

Therefore, the survivor benefit need to be paid out within 5 years of the very first proprietor's fatality, or based on the 2 exceptions (annuitization or spousal continuance). If an annuity is held jointly in between a spouse and partner it would appear that if one were to pass away, the other could merely continue ownership under the spousal continuation exception.

Assume that the partner and spouse named their child as beneficiary of their jointly-owned annuity. Upon the fatality of either proprietor, the company should pay the death advantages to the kid, who is the beneficiary, not the surviving partner and this would probably defeat the owner's intentions. Was wishing there may be a mechanism like setting up a beneficiary IRA, however looks like they is not the instance when the estate is configuration as a beneficiary.

That does not determine the sort of account holding the inherited annuity. If the annuity remained in an inherited individual retirement account annuity, you as administrator need to be able to designate the acquired IRA annuities out of the estate to inherited Individual retirement accounts for each estate recipient. This transfer is not a taxed occasion.

Any circulations made from acquired IRAs after assignment are taxed to the recipient that got them at their regular earnings tax obligation rate for the year of distributions. If the acquired annuities were not in an IRA at her death, then there is no means to do a direct rollover into an acquired Individual retirement account for either the estate or the estate recipients.

If that occurs, you can still pass the distribution with the estate to the individual estate recipients. The tax return for the estate (Kind 1041) could consist of Kind K-1, passing the revenue from the estate to the estate recipients to be taxed at their private tax obligation rates as opposed to the much higher estate earnings tax obligation prices.

Do you pay taxes on inherited Lifetime Annuities

: We will certainly create a plan that consists of the very best items and features, such as enhanced fatality benefits, premium rewards, and irreversible life insurance.: Get a tailored strategy designed to maximize your estate's value and reduce tax obligation liabilities.: Apply the picked strategy and get ongoing support.: We will certainly aid you with setting up the annuities and life insurance policy plans, providing continuous guidance to make certain the plan remains effective.

Nevertheless, should the inheritance be considered as a revenue connected to a decedent, after that tax obligations might apply. Usually speaking, no. With exception to retirement accounts (such as a 401(k), 403(b), or IRA), life insurance policy profits, and cost savings bond interest, the recipient generally will not have to birth any earnings tax obligation on their inherited wealth.

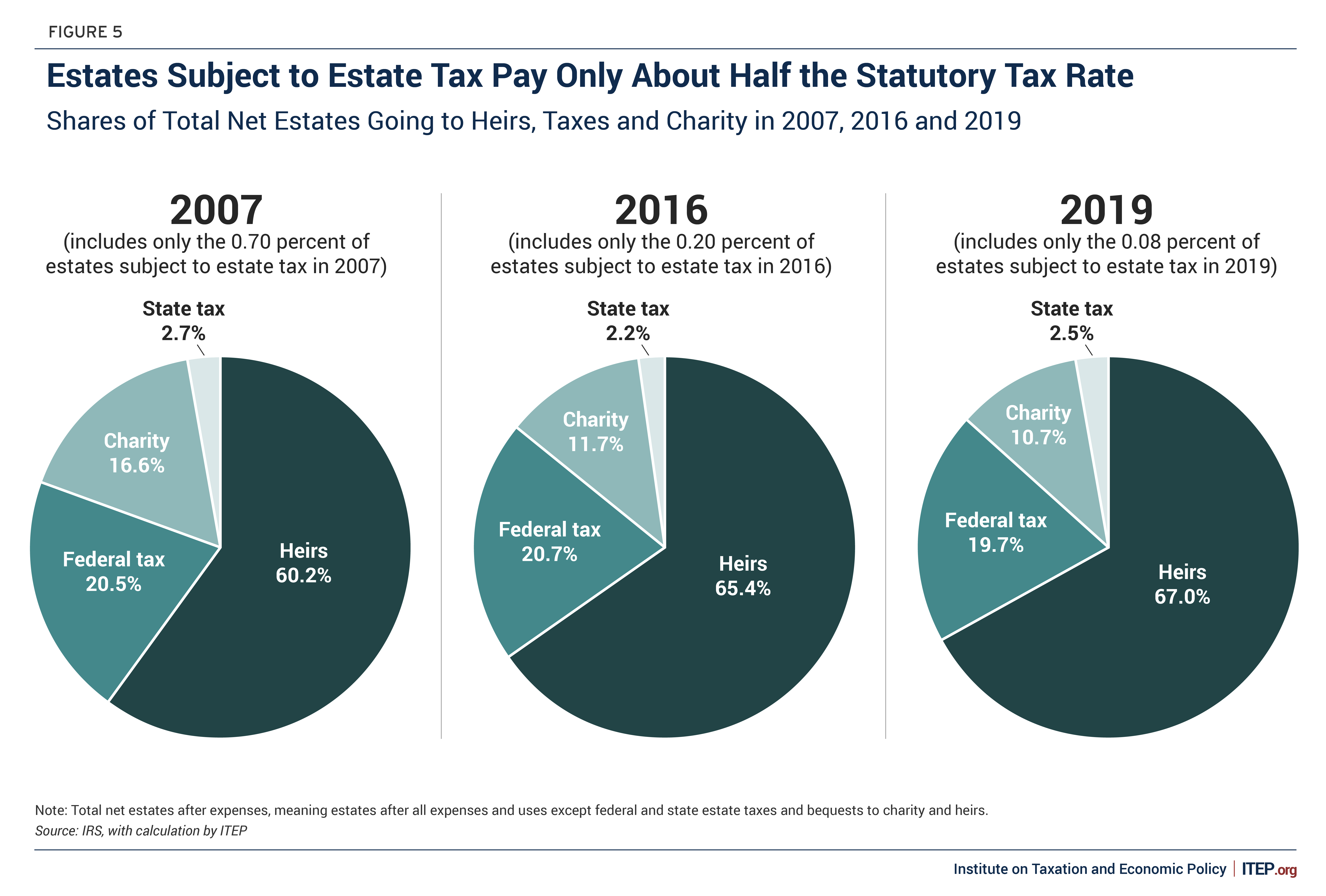

The quantity one can inherit from a count on without paying tax obligations depends upon different aspects. The government estate tax exception (Joint and survivor annuities) in the United States is $13.61 million for people and $27.2 million for wedded couples in 2024. Private states might have their very own estate tax obligation policies. It is a good idea to speak with a tax specialist for exact details on this issue.

His objective is to simplify retirement planning and insurance policy, guaranteeing that clients comprehend their choices and safeguard the very best insurance coverage at unsurpassable prices. Shawn is the creator of The Annuity Professional, an independent online insurance policy agency servicing customers throughout the USA. With this system, he and his team objective to get rid of the uncertainty in retired life preparation by assisting people locate the very best insurance policy protection at one of the most affordable rates.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Annuity Or Variable Annuity Why Choosing t

Highlighting the Key Features of Long-Term Investments Key Insights on Deferred Annuity Vs Variable Annuity Defining the Right Financial Strategy Benefits of Fixed Annuity Vs Equity-linked Variable An

Understanding Financial Strategies Key Insights on Fixed Vs Variable Annuities What Is What Is A Variable Annuity Vs A Fixed Annuity? Advantages and Disadvantages of Different Retirement Plans Why Def

More

Latest Posts